how to sell on stock c | how to sell stock before buying how to sell on stock c It may also prompt investors to sell their profitable investments more frequently, . DITEK’s DTK-LVLP Low Voltage Line Protector series of signal, data and loop circuit surge protectors provide strong protection in a compact hard wired package. Models are available to protect up to 8 pairs. LVLAWG models can handle #14-#10 AWG wiring connections. Both are suitable for AC and DC circuits. DTK-2LVLPLV. DTK-4LVLPX. Product Features.

0 · how to start selling stocks

1 · how to sell stocks for profit

2 · how to sell stocks for free

3 · how to sell stocks

4 · how to sell stock for beginners

5 · how to sell stock before buying

6 · how much to sell stocks

7 · buying and selling stocks

Draugiem.lv mobilā versija ļaus Tev vienmēr būt pieskāriena attālumā no Taviem draugiem, sūtīt viņiem vēstules, skatīties galerijas un sekot jaunumiem profilos. Ērti, vienkārši un bez maksas. Ienāc un pārliecinies.

How to Cash Out Your Stocks: 5 Steps. Motivations for Selling Stocks. Understanding Types of Sell Orders. Factors to Assess When Cashing Out Stocks. Pros and Cons of Reinvesting Profits. Platforms for Buying and Selling Stocks. FAQ. Buying stocks can .When seeing stock market charts and business news headlines, it can be .

It may also prompt investors to sell their profitable investments more frequently, . How to Cash Out Your Stocks: 5 Steps. Motivations for Selling Stocks. Understanding Types of Sell Orders. Factors to Assess When Cashing Out Stocks. Pros and Cons of Reinvesting Profits. Platforms for Buying and Selling Stocks. FAQ. Buying stocks can be fairly straightforward, whether online or through a financial advisor.Interested in buying and selling stock? Benzinga breaks down how to sell stock, including factors to consider before you sell your shares. These methods are the valuation-level sell, the opportunity-cost sell, the deteriorating-fundamentals sell, the down-from-cost and up-from-cost sell, and the target-price sell.

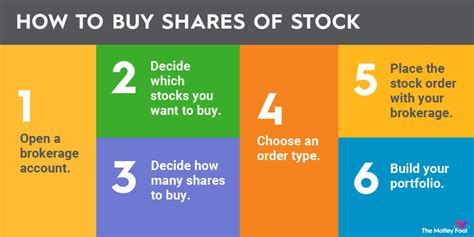

Here's the step-by-step guide for how to sell stock, including how to navigate order types, fill in a trade ticket and choose an order expiration. Steps to sell stock. When you’ve decided to sell your stocks, here are the steps you'll need to take. 1. Choose your order type. Order types manipulate the timing of sales. By choosing the correct order type for your sale, the goal is to minimize losses and maximize gains.Buying or Selling C Corporation Stock. August 31, 2013. C Corporation Income Taxation. Editor: Albert B. Ellentuck, Esq. Unlike an asset sale, a taxable stock sale does not result in the recognition of taxable income or loss at the corporate level.

April 17, 2023. What’s the difference between a stock sale and an asset sale, and why would a buyer or seller prefer one over the other? We’ll discuss the differences and highlight the tax issues affecting both buyers and sellers involved in C corporation merger and acquisition transactions. Generally, the easiest way to ensure stock sale treatment is to sell all of your stock back to the corporation in a complete redemption. For a complete redemption to qualify as a stock sale, you cannot constructively own any shares after the redemption. There are three types of sell orders to choose from when selling your stock. It helps to work with a financial advisor to understand your stocks' values better if you’re unsure. There are many techniques for helping you decide when to sell a stock, but the best one is to set a target price and sell the stock when it hits that level.

how to start selling stocks

The gain on sale is taxed only once at the owner’s individual level (on their individual income tax return) for the gain on sale of the stock, just as they would be with a gain on sale of any publicly traded security (e.g., Amazon, Google, Apple, etc.). There is . How to Cash Out Your Stocks: 5 Steps. Motivations for Selling Stocks. Understanding Types of Sell Orders. Factors to Assess When Cashing Out Stocks. Pros and Cons of Reinvesting Profits. Platforms for Buying and Selling Stocks. FAQ. Buying stocks can be fairly straightforward, whether online or through a financial advisor.

Interested in buying and selling stock? Benzinga breaks down how to sell stock, including factors to consider before you sell your shares.

These methods are the valuation-level sell, the opportunity-cost sell, the deteriorating-fundamentals sell, the down-from-cost and up-from-cost sell, and the target-price sell.

Here's the step-by-step guide for how to sell stock, including how to navigate order types, fill in a trade ticket and choose an order expiration.

Steps to sell stock. When you’ve decided to sell your stocks, here are the steps you'll need to take. 1. Choose your order type. Order types manipulate the timing of sales. By choosing the correct order type for your sale, the goal is to minimize losses and maximize gains.Buying or Selling C Corporation Stock. August 31, 2013. C Corporation Income Taxation. Editor: Albert B. Ellentuck, Esq. Unlike an asset sale, a taxable stock sale does not result in the recognition of taxable income or loss at the corporate level.April 17, 2023. What’s the difference between a stock sale and an asset sale, and why would a buyer or seller prefer one over the other? We’ll discuss the differences and highlight the tax issues affecting both buyers and sellers involved in C corporation merger and acquisition transactions.

Generally, the easiest way to ensure stock sale treatment is to sell all of your stock back to the corporation in a complete redemption. For a complete redemption to qualify as a stock sale, you cannot constructively own any shares after the redemption. There are three types of sell orders to choose from when selling your stock. It helps to work with a financial advisor to understand your stocks' values better if you’re unsure. There are many techniques for helping you decide when to sell a stock, but the best one is to set a target price and sell the stock when it hits that level.

how to sell stocks for profit

dior homme black classic skinny suits

dior homme blacktie 2.0b

dior homme cologne รีวิว

how to sell stocks for free

As of Phase 3, April 16, 2024, Blizzard has swapped the slots for the Lacerate (previously Gloves) and Skull Bash (previously Legs) Runes. Here is where you will find all our Rune Guides, with exact locations, maps, walkthroughs, and tips and tricks for all Druid runes through Level 25: Druid Rune. Level.

how to sell on stock c|how to sell stock before buying